투자 초보를 위한 각종 금융용어 정리 및 해석 Organizing and interpreting various financial terms for investment beginners

bp (basis point)

: 이자율을 계산할 때 사용하는 최소의 단위. 1%는 100bp이고 1bp는 0.01%다.

A basis point (abbreviated as "bp") is a unit of measure commonly used in finance to describe small percentage changes or differences in interest rates, bond yields, or other financial instruments. One basis point is equal to one one-hundredth of a percent (0.01%). In other words, 100 basis points make up 1%.

PCE (Personal Consumption Expenditure)

: 일정 기간 개인이 물건을 구입하거나 서비스를 이용하는 데 지출한 모든 비용을 합친 금액으로, 매월 미국 상무부 경제분석국에서 발표하고 있다. 개인소비지출은 미국 정부가 인플레이션(물가상승)의 정도를 파악해 금리 인상이나 인하 유무를 판단하는 주요 지표가 되고 있다.

: 둔화세를 보이면 연준의 내년 금리 인하 기대감은 더욱 강화될 전망입니다.

Personal Consumption Expenditure (PCE) is a measure used in economics to gauge the level of consumer spending within an economy. It represents the total value of goods and services purchased by individuals and households for consumption purposes. PCE is considered a key indicator of economic activity and is closely monitored by policymakers, economists, and investors to assess the health and direction of the economy.

ETF (Exchange Traded Funds, 상장지수펀드)

: 상장지수펀드로 특정지수를 모방한 포트폴리오를 구성하여 산출된 가격을 상장시킴으로써 주식처럼 자유롭게 거래되도록 설계된 지수상품

Similar to a mutual fund, but trades on stock exchanges like a stock. It typically holds assets such as stocks, commodities, or bonds, and aims to track the performance of a specific index.

CPI (Consumer Price Index, 소비자물가지수)

: 소비자가 일상생활에 쓰기 위하여 구입하는 재화와 서비스(소비재)의 가격변동을 나타내는 물가지수

The Consumer Price Index (CPI) is a measure used to track changes in the price level of a basket of goods and services purchased by households. It is one of the most commonly used indicators for measuring inflation and is published regularly by government statistical agencies, such as the U.S. Bureau of Labor Statistics (BLS).

미국달러지수 (U.S. Dollar Index(USDX))

: 세계 주요 6개 통화인 유로, 일본 엔, 영국 파운드 스털링, 캐나다 달러, 스웨덴 크로나, 스위스 프랑의 가치에 경제규모에 따라 비중을 달리하여 산출한 값을 미국 달러와 비교한 지표이다. 달러 가치가 하락했다는 말은 따라서 주요 6개국의 통화와 비교했을 때 그 가치가 하락했다는 의미라고 할 수 있다. 따라서 달러의 절대적 가치, 달러의 '전투력' 정도로 볼 수 있다.

The U.S. Dollar Index (USDX) is a measure of the value of the United States dollar relative to a basket of foreign currencies. It provides a weighted average of the dollar's exchange rates against a selection of major currencies, primarily the euro (EUR), Japanese yen (JPY), British pound (GBP), Canadian dollar (CAD), Swedish krona (SEK), and Swiss franc (CHF).

커버드콜 (covered-call)

: 주식과 옵션을 동시에 거래하는 것으로, 주식을 보유한 상태에서 콜옵션을 다소 비싼 가격에 팔아 위험을 안정적으로 피하는 방식이다. 커버드콜은 시장이 상승기에 있을 때에는 수익을 제한하기도 하지만, 하락기의 시장에서는 행사가격의 콜옵션을 매도해 얻은 프리미엄 수입으로 주가하락에 따른 위험을 줄일 수 있다는 장점이 있다. 이에 커버드콜 전략은 일반적으로 향후 주식시장이 보합세를 유지하거나 강세가 전망되어도 그 정도가 약하다고 예측될 때 하락에 따른 손실을 줄일 수 있는 방법으로 행해진다.

A Covered Call, also known as a "buy-write" strategy, is an options trading strategy where an investor holds a long position in an asset (such as stocks) and simultaneously sells (or writes) call options on that same asset. In simpler terms, it involves owning the underlying asset and selling call options against it.

콜옵션 (call option)

: 옵션은 미래의 특정시기에 특정가격으로 팔거나 살 수 있는 권리 자체를 현재시점에서 매매하는 계약으로, 특정 주식을 살 수 있는 권리인 콜(call)옵션과, 팔 수 있는 권리인 풋(put)옵션으로 구분된다.

A Call Option is a financial contract that gives the buyer the right, but not the obligation, to purchase a specific asset (such as stocks, commodities, or currencies) at a predetermined price (known as the strike price) within a specified period of time (until expiration). In exchange for this right, the buyer pays a premium to the seller of the option.

현행수익률 (current yield)

: 앞으로 이자수익과 자본이득의 현 흐름을 예상하며 채권을 매입할 경우, 이 채권의 이자수익으로 얻는 수익률을 뜻하는 말. 경상 수익률이라고도 하며, 이자를 채권가격으로 나눠서 계산한다. 투자한 채권 금액 대비 얻게 되는 이자금을 단순하게 나타낸 수익률이다.

Current yield, in the context of bonds or other fixed-income securities, refers to the annual income generated by an investment relative to its current market price. It is calculated by dividing the annual interest or dividend payment by the current market price of the security, expressed as a percentage.

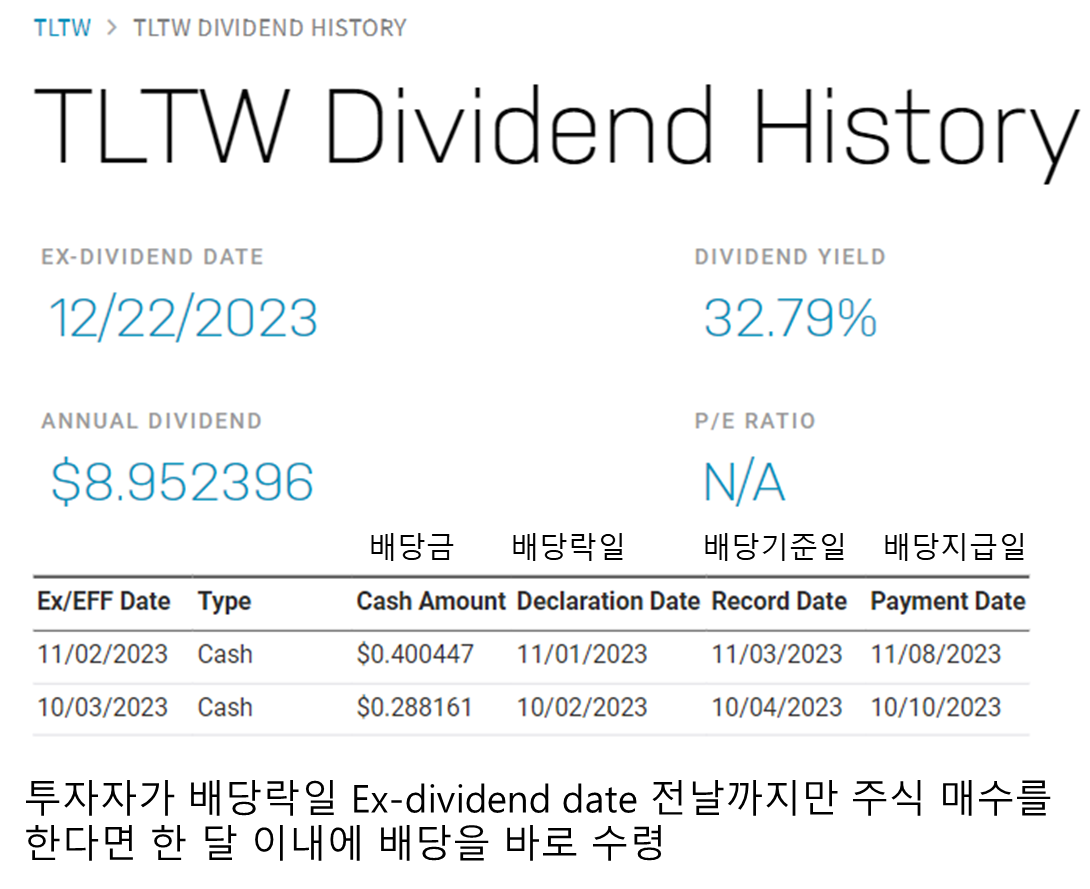

미국 채권 ETF current yield (2024.01.08)

TLTW: 33.03%

TMF: 3.35%

Dividend: A portion of a company's earnings that is paid out to shareholders on a regular basis, usually quarterly. Dividends can provide a steady income stream for investors.

Fixed Income

: 채권, 금융상품, 예금증서, CD(저축증서) 등, 일정 기간 내에 고정된 이자 수익을 제공하는 투자 상품을 의미. 따라서, "Fixed Income"은 채권에 대한 일종의 대표적인 용어로 사용되기도 함. "FICC"는 "Fixed Income, Currencies, and Commodities"의 약어로, 채권, 통화, 원자재 등의 금융상품을 다루는 금융 거래 부문을 의미합니다. 그러므로, "FICC"에서의 "FI"는 "Fixed Income"을 의미하며, 채권을 포함한 "Fixed Income" 관련 거래를 수행하는 부서나 업무를 의미합니다.

Fixed income refers to a type of investment that provides a steady and predictable stream of income over a specified period of time. Unlike stocks, which represent ownership in a company and may offer variable returns through dividends and capital appreciation, fixed income investments typically involve loans made by investors to governments, corporations, or other entities in exchange for regular interest payments and the return of the principal amount at maturity.

샤프지수 (Sharpe ratio)

: 표준편차를 이용하여 펀드의 성과를 평가하는 지표. 값이 높을수록 펀드의 수익률이 우수하다는 것을 보여준다. 샤프 비율이 3.0 이상이면 우수한 것으로 간주됩니다.

The Sharpe Ratio, named after Nobel laureate William F. Sharpe, is a measure used to evaluate the risk-adjusted return of an investment or portfolio. It assesses the excess return generated by an investment relative to the level of risk taken to achieve that return. In other words, it quantifies the amount of return received for each unit of risk assumed.

CDS (Credit Default Swap, 신용부도스와프)

: 금융기관이 채권이나 대출을 해준 기업의 채무불이행 등의 신용위험에 대해 일정한 수수료(프리미엄)를 지급하는 대가로, 보장매입자가 신용사건 발생 시 손실을 보장받는 일종의 파생보험상품이다.

: 부도위험을 나타내는 신용디폴프스와프(CDS) 프리미엄

A Credit Default Swap (CDS) is a financial derivative contract that allows an investor to buy protection against the risk of default on a debt instrument, such as a corporate bond or loan. In simpler terms, it's a form of insurance against the possibility that a borrower will fail to make timely payments on their debt obligations.

<시장 주기 Market Cycle>

금,비트코인: 경기침체 예상 -> 가격상승

WTI유: 경기불황 -> 하락

원유,비철금속: 제조업지수 좋으면 -> 상승

국채금리는 내림세를 보이면서 주가도 상승 흐름

물가가 내릴것이라고 예상되면 채권금리는 내려가고

물가가 오를것이라고 예상되면 채권금리는 올라가고

시장금리 상승 -> 채권 가격 하락

시장금리 하락 -> 채권 가격 상승

채권의 이자율과 시장금리와의 차이가 채권의 가격을 결정

채권금리가 내리면 채권가격은 오른다. 채권 금리는 가격과 반대로 움직여, 금리 하락은 가격 상승을 뜻한다.

시장금리가 내리면 신규채권 금리도 낮아지는데 이럴 경우 기존 발행된 채권의 수요가 증가함으로 가격이 오른다.

물가상승 -> 원자재 ETF

빠른 속도로 금리를 인상할 것 -> 금 ETF